Keep Your Investment Appetite in Check

Resisting sudden shifts during market downturns, like avoiding impulse buys when hungry, can help investors stay balanced and positioned for a market recovery.

Everyone knows it’s ill-advised to go grocery shopping when you’re hungry. Your appetite in the moment is different than in normal circumstances, so you’re likely to buy foods you’ll never actually eat. I break this rule all the time, which is how I end up with four boxes of frozen mozzarella sticks.

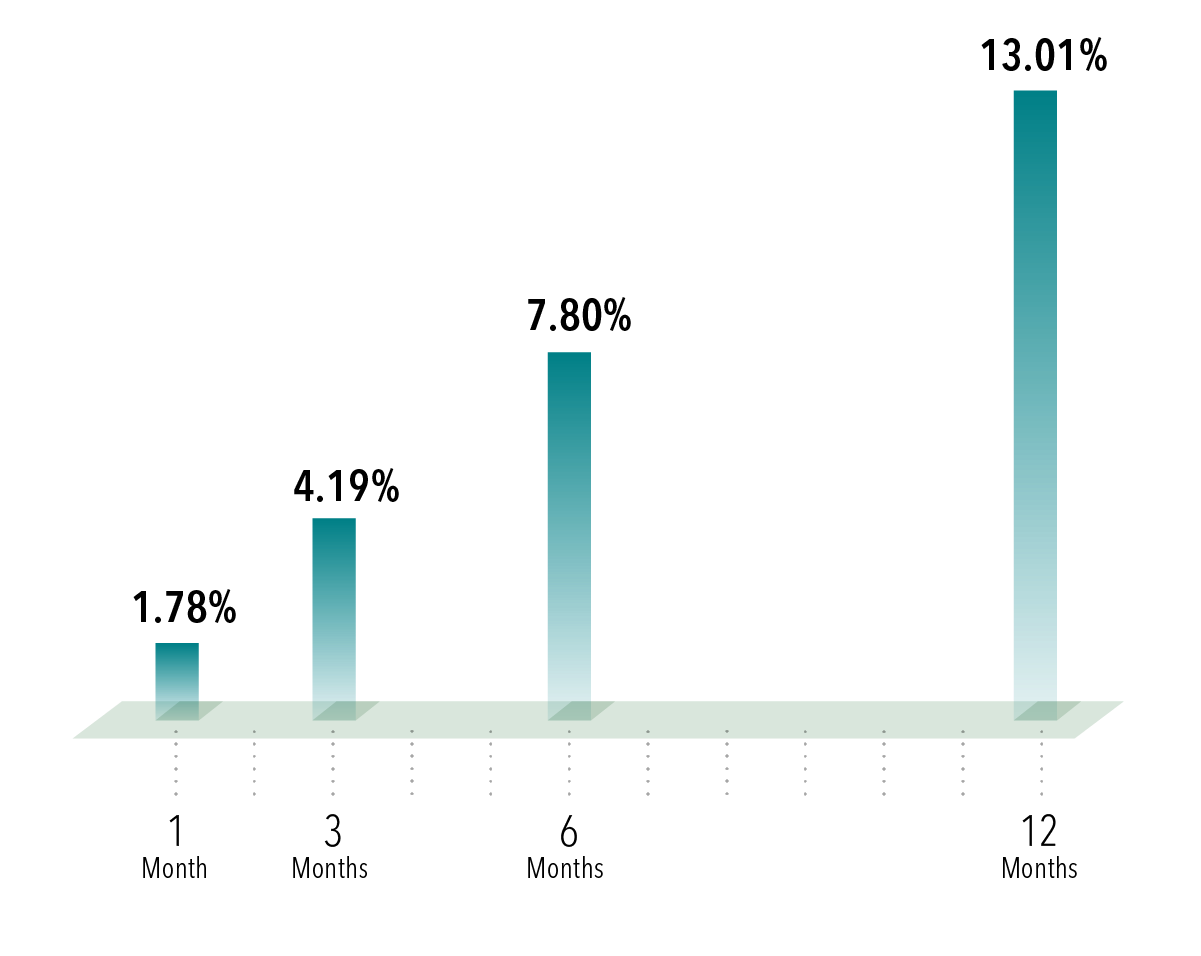

Similar caution should apply when it comes to asset allocations in the wake of market downturns. When stocks decline, investors may be tempted to move into cash in order to avoid any further losses. That’s only natural, as the appetite for risk likely changes following the first drop. However, history tells us that’s probably the wrong move. A balanced asset allocation of 60% stocks and 40% bonds has on average outpaced cash in periods following three-month market declines. An investor sitting on the sideline might eventually turn nauseous at the missed opportunity from a market rebound.

Exhibit 1

Appetite for Destruction

Average relative outperformance of a 60/40 portfolio vs. a cash allocation following a 3-month US stock market decline of 10% or more, February 1982–June 2025

This article originally appeared in Above the Fray, a weekly newsletter for Dimensional clients. It was not created, written, or produced by TwoTen Planning.

Disclosures

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

UNITED STATES

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.

The foregoing content reflects the opinions of TwoTen Planning and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as financial, legal, tax, or investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee or assurance that diversification, strategies based on Nobel prize-winning research, or any investment plan or strategy will be successful.

Our Most Recent Blogs

Check out our most recent blogs where we share insightful articles, trends, and news from a Christ-centred perspective in the financial industry.

“For we are His workmanship, created in Christ Jesus for good works, which God prepared beforehand that we should walk in them.”